Cash back. Who doesn’t love the sound of that, especially when everything seems more expensive every day? You might be surprised at all the ways you can use those cash back rewards to not only fatten your wallet in the short term but also work toward your financial goals. I’m not just talking about redeeming for a few bucks off a statement (although that’s great too).

Let’s explore 5 savvy strategies for maximizing cash back rewards to unlock their full potential. But first, it’s helpful to understand just what makes cash back rewards so valuable. Unlike points, which can fluctuate in value depending on how you redeem, cash back typically comes in the form of a statement credit or a deposit to your checking account. It provides clear value, flexibility, and control, allowing you to allocate it as you see fit.

Table Of Contents:

5 Savvy Strategies for Maximizing Cash Back

This is where the fun begins. Let’s explore those five rewarding strategies:

1. Conquer Your Credit Card Statement

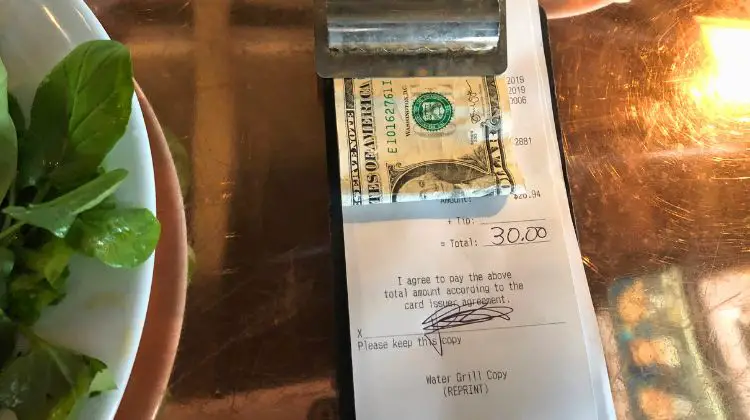

I get it – this is the obvious one. But applying cash back to your statement balance is popular for a reason. Imagine: for every $100 you spend, your card gives you $1 back, so it’s like getting a 1% discount on everything. Over time, consistently applying cash back to your statement balance adds up to less debt and, consequently, less interest paid.

2. Grow Your Cash Back Stash

Instead of simply reducing your credit card balance, why not deposit your cash back into a high-yield savings account? While your credit card may offer a decent interest rate, it will probably never be as high as you could get from one of the best savings accounts. Plus, seeing your cash back grow encourages saving even more.

3. Fuel Your Future with an IRA

Ready to get creative? Consider using your cash back to fund an IRA. IRAs, whether Roth or Traditional, can jumpstart your retirement savings and offer valuable tax advantages. Imagine: your everyday spending, fueled by strategic use of cash back credit cards, quietly building your retirement nest egg.

If you’re interested in learning about investment strategies that align with maximizing your financial gains, exploring resources on strategies for maximizing earnings in different domains might offer valuable insights. Keep in mind that IRAs do come with annual contribution limits and regulations. Always review those IRS guidelines.

4. Explore Taxable Brokerage Accounts

For more advanced savers, a taxable brokerage account could be the answer. If you’ve maxed out your IRA contributions for the year, dipping your toes into a taxable brokerage account could help maximize growth. These accounts, unlike retirement accounts, give you flexibility. Transferring cash back credit card rewards to a brokerage account is one of the ways that I help compound my own rewards.

For example, you can withdraw from these accounts at any time. However, be prepared to potentially owe taxes on any gains. Still, the flexibility to invest your cash back and potentially build wealth with stocks, bonds, ETFs, and mutual funds makes taxable brokerage accounts appealing to more active investors. This strategy might offer valuable lessons and parallels for those exploring different investment avenues, even something like the strategies for maximizing tax savings methods detailed in specific geographical contexts.

As a bonus, the IRS considers cash back from credit cards as a rebate, so they’re not taxable (the growth or income generated from your taxable brokerage account will be taxable though).

5. Bank Your Rewards for Travel Perks

For the travel lovers, using cash back toward future trips is an exciting way to offset travel costs. You work hard all year; shouldn’t you enjoy that time off without breaking the bank? Consider pairing this approach with cards offering travel perks. The Chase Freedom Unlimited®, for instance, offers bonus cash back or points when you redeem your rewards for travel through their portal. Capital One’s Venture X is another great choice when it comes to premium travel rewards cards. Their travel booking site is one of my favorites to use. Their travel booking dashboard allows you to redeem miles from a travel card and cash back earned from a cash back card.

We use two types of credit cards in our house. One is cash back, and one is travel rewards. To be honest, the travel rewards are my favorite because I love creating vacation memories with my family. Sometimes wealth isn’t just about growing your nest egg. Chase, American Express, and Capital One cash back cards make it easy to redeem cash back for travel if you prefer keeping your rewards system a bit more simple.

Conclusion

Cash back is so much more than a simple statement credit. Five savvy strategies for maximizing cash back rewards exist; it all boils down to what suits your financial goals best.

Remember: maximizing those cash back rewards empowers you to pay off debt, boost savings, invest for a comfortable retirement, or finally take that bucket-list vacation. By viewing your cash back rewards as more than just pocket change and being strategic, you gain a powerful tool to improve your financial life, one transaction at a time. You’ve got this.

Reader Interactions